ISS and Glass Lewis 2026 Policy Updates

Both ISS and Glass Lewis recently released updates to their 2026 pay-for-performance models and proxy voting guidelines, which will apply to annual meetings held on or after February 1, 2026. This article outlines updates to executive and non-employee director compensation and director election voting recommendations that could affect proxy advisory firms’ voting recommendations for the 2026 proxy season.

Pay-for-Performance Evaluation

ISS conducts a CEO pay-for-performance analysis to identify alignment between pay and performance over a sustained period. The changes to the primary screens are outlined below:

- Relative Degree of Alignment (RDA): The evaluation period will be extended from three years to five years.

- Multiple of Medium (MOM): The measure is updated to lengthen the time horizon assessed from one year to the average of a one-year assessment and three-year assessment of CEO pay.

- Pay-TSR Alignment (PTA): No changes will be made to this test for 2026.

Once the three primary screens have been calculated, ISS conducts a secondary test. For 2026, ISS also made changes to this calculation outlined below:

- Financial Performance Assessment (FPA): The measurement period will be extended from three years to five years.

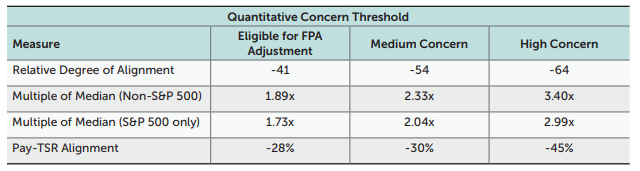

ISS adjusted the thresholds for each of the tests, which determines if a company is eligible to have their concern levels modified based on the FPA:

- RDA: Thresholds for eligibility for FPA adjustment, medium, and high concerns were changed from -38 to -41, from -50 to -54, and from -60 to -64, respectively.

- MOM for non-S&P 500 companies: Thresholds for eligibility for FPA adjustment and high concern were changed from 1.84x to 1.89x and from 3.33x to 3.40x. There was no change to the medium concern threshold of 2.33x.

- MOM for S&P 500 companies: Thresholds for eligibility for FPA adjustment, medium and high concern were changed from 1.69x to 1.73x, from 2.00x to 2.04x, and from 3.00x to 2.99x, respectively.

- PTA: Thresholds for eligibility for FPA adjustment changed from -25% to -28%. There was no change to the medium or high concern threshold of both -30% and -45%.

ISS’ concern thresholds for each test for 2026 are presented below:

ISS also expanded on the factors that they consider in their qualitative evaluation for the pay-for-performance evaluation. New additional considerations for 2026 are outlined below:

- The time horizons of pay structures, including vesting and measurement periods, and retention requirements.

- The rationale for pay structure, pay decisions, or for unusual or special circumstances.

- Relevant industry or other external factors impacting company performance or pay decisions, to the extent explained by company disclosure.

ISS also added a new factor for 2026 that will be considered as part of their qualitative evaluation of performance equity award programs:

- A short-term performance measurement period design.

ISS explains that these changes are designed to strengthen the evaluation of pay and performance alignment by using a longer time horizon while still maintaining a short-term view of pay magnitude. Extending the assessment period from three to five years is intended to better reflect how investors evaluate long-term results when comparing executive pay to peer companies. This approach emphasizes sustained value creation and helps minimize the influence of short-term volatility, one-off events, or external factors.

|

CAP Perspective:

ISS’s 2026 methodology changes signal a stronger shift toward evaluating pay and performance over a true long-term horizon, and companies should prepare accordingly. The extension of key tests, from three years to five, means legacy pay decisions and long-term stock price will play a larger role in Say-on-Pay voting recommendations. Public companies should start assessing their five-year pay and performance trajectory now and model ISS outcomes under the new framework. |

Company Financial Performance Evaluation in the Qualitative Evaluation

ISS also expanded on how they consider a company’s financial performance in the qualitative evaluation. ISS incorporates a company’s financial and operational performance into its qualitative evaluation by reviewing GAAP results from Compustat, company-disclosed adjusted metrics, and EVA-based economic performance. These data points provide greater context for pay decisions and can help inform the qualitative review explaining outcomes such as above-target incentive payouts despite weak TSR.

|

CAP Perspective:

ISS’s expanded use of GAAP, adjusted, and EVA-based performance measures represents an opportunity for companies to present a more complete and defensible rationale for pay outcomes. By incorporating multiple financial and operational indicators into its qualitative assessment, ISS is signaling a shift toward a more balanced view of performance beyond TSR alone. For companies, this means strengthening disclosures, ensuring the credibility and consistency of adjusted metrics, and clearly articulating how underlying financial results support incentive payouts. |

Other Notable Pay Considerations

Carried Interest / Profit-Sharing Program: For 2026, ISS added context around different forms of compensation and how they evaluate each. ISS states that they treat carried-interest and profit-sharing programs as incentive compensation, incorporating their often-uncapped payouts into both the quantitative screen and qualitative evaluation. In reviewing these programs, ISS considers the rationale, performance requirements, payout determination process, and safeguards such as reasonable pay opportunities and meaningful caps to assess whether they support pay-for-performance alignment.

Bonus Plans Based on a Discretionary Assessment / Individual Performance: Some companies, especially large financial firms, use discretionary bonus programs where NEO pay is based on holistic company and individual performance rather than measurable, pre-set goals. Investors generally view these structures negatively, particularly when pay and performance appear misaligned, because they lack transparency and clear performance linkages. Providing disclosures such as metric weightings, performance thresholds, and defined payout opportunities can help mitigate concerns, while their absence reinforces perceived misalignment.

Security Related Perquisites: Many companies are increasing executive security benefits, and some investors view these costs differently from typical perquisites. ISS is generally unlikely to raise concerns about higher security-related expenses if the company provides a clear rationale, such as an internal or third-party assessment and an explanation of how the program supports shareholder interests. However, exceptionally large or poorly explained security costs may still trigger scrutiny

|

CAP Perspective:

Public companies should review all forms of incentive compensation to ensure they are clearly aligned with performance and supported by robust disclosure. Programs should be benchmarked against market practices, include well-defined performance metrics and payout limits, and be accompanied by transparent disclosure of rationale and governance safeguards. For security-related perquisites, companies should provide thorough explanations of the need, cost, and shareholder benefit to mitigate potential concerns and demonstrate sound governance. |

Time-Based Equity Awards with Long-Time Horizon

ISS announced that going forward they will give companies more flexibility in how their equity mix is evaluated by placing greater emphasis on the long-term nature of time-based awards in the qualitative pay-for-performance review. The policy update also clarifies that realized pay outcomes may be considered alongside realizable and granted pay.

Per ISS, investor feedback from recent surveys and policy roundtables indicates shifting views on the balance between time and performance-based equity, with many institutional investors voicing concerns about performance award structures and supporting the inclusion of time-based equity as a majority of the mix when it carries extended vesting or retention requirements. Under the updated approach, longer term vesting for time-based awards will be viewed more favorably, while equity programs will continue to be assessed holistically and case-by-case based on company-specific context. ISS also notes that well-designed and clearly disclosed performance equity programs will remain a positive factor in the qualitative evaluation. Finally, they state that this increased flexibility for time-based awards will not apply to special or one-time awards and those grants should still be strongly based on performance-vesting criteria.

|

CAP Perspective:

ISS’s updated guidance signals a shift in how time-based equity is viewed in qualitative pay-for-performance evaluations. Companies now have more flexibility, as extended vesting on time-based awards can be seen as supporting long-term alignment, particularly when performance metrics are complex or poorly correlated with shareholder value creation. Nevertheless, we expect most companies to retain at least 50% performance-based long-term incentives (LTI) because investors and proxy advisors continue to view performance-conditioned awards as a critical indicator of pay-for-performance alignment and a safeguard against windfall compensation. As a result, CAP expects the majority of companies to maintain at least 50% of their LTI in performance-based awards in the near term, and ISS will continue to evaluate program design, disclosure quality, vesting rigor, and overall pay-for-performance alignment. Companies relying more on time-based equity should ensure long vesting periods, clear retention objectives, and a thorough rationale in the CD&A. |

Company Responsiveness to Low Say-on-Pay Support

ISS amended their policies for Company Responsiveness to low Say-on-Pay support, which is defined as support of less than 70% of votes cast. For 2026, ISS announced that they will allow greater flexibility for companies to demonstrate responsiveness when the company’s previous Say-on-Pay received support of less than 70% by evaluating the company’s rationale for actions taken in cases where the company discloses meaningful engagement efforts but was unable to obtain specific feedback. Specific examples include:

- Whether these issues raised were repetitive or isolated.

- The company’s ownership structure.

- Significant company activity such as a merger or proxy contest.

ISS explains that these policy changes are intended to give companies greater flexibility in demonstrating responsiveness after receiving low Say-on-Pay support, especially when they have made genuine efforts to engage but were unable to gather investor feedback due to circumstances such as recent SEC guidance that may limit engagement. Per ISS, feedback from surveys and investor roundtables showed strong support for not penalizing companies that disclose good-faith engagement attempts, and for recognizing that meaningful compensation changes can still reflect responsiveness even without direct shareholder input. The update also clarifies how ISS will evaluate low Say-on-Pay results in atypical situations, such as proxy contests, mergers, or bankruptcies, by considering the company’s engagement efforts, the board’s assessment of investor concerns, related compensation actions, and any significant board turnover.

|

CAP Perspective:

This is a meaningful shift, as ISS recognizes that some companies make good-faith engagement efforts but cannot always obtain specific feedback, particularly following recent SEC guidance that may limit engagement. Under the new policy, what matters most is clear disclosure. Companies should be prepared to articulate their engagement efforts, explain how the board evaluated likely investor concerns, and show that compensation actions taken reflect a thoughtful and responsive approach. |

Board Diversity as a Voting Factor

ISS amended their policies regarding board diversity, specifically the consideration of gender and racial / ethnic diversity in director election or re-election recommendations. For 2026, ISS announced that it will indefinitely suspend the use of board gender and racial /ethnic diversity as a factor in making vote recommendations for the election or re-election of directors at U.S. companies. ISS will no longer recommend votes “Against” directors solely due to a lack of gender or racial / ethnic diversity on the board.

|

CAP Perspective:

With this update, ISS is acknowledging the evolving landscape and regulatory environment around board diversity. Public companies should review their board composition and related governance disclosures to ensure they remain aligned with investor expectations and best practices, even as external diversity mandates are paused. |

Excessive Non-Employee Director Pay

Previously, ISS generally recommended “Against” specific board members on the committee responsible for approving non-employee director pay only after two or more consecutive years of awarding excessive compensation without adequate disclosure of the rationale. Excessive compensation is defined as director compensation that falls within the top 2–3% of companies within the same industry GICs. For 2026, adverse recommendations can now occur after the first year if the compensation is deemed egregious, or in subsequent years if a pattern emerges across non-consecutive years. “Egregious” compensation includes performance awards, retirement benefits, or problematic perquisites.

This change allows ISS to address issues in the first year of occurrence or in the event of a pattern identified across non-consecutive years. Non-employee director pay that only slightly exceeds thresholds, without other risk factors or a multi-year pattern, will continue to generate warnings rather than adverse vote recommendations.

|

CAP Perspective:

Public companies should review their non-employee director compensation programs to ensure they are competitive but not excessive. All pay elements should be carefully benchmarked and documented with a robust rationale. |

Equity-Based and Other Incentive Plans

For 2026, ISS has introduced a new scoring factor under the Plan Features pillar of the Equity Plan Scorecard (EPSC) that evaluates whether plans covering non-employee directors clearly disclose any cash-denominated award limits. For 2026, the new factor focusing on cash-denominated award limits will apply to S&P 500 and Russell 3000 EPSC models.

ISS states that the update aims to strengthen the Plan Features pillar by converting the previously informational disclosure of non-employee director award limits into a scored factor, reflecting best practices for plans that include directors.

Additionally, ISS will implement a new negative overriding factor, where an equity plan proposal may receive an “Against” recommendation if it lacks sufficient positive features within the Plan Features pillar. This update applies to S&P 500, Russell 3000, and non-Russell 3000 models.

ISS noted that some plans historically passed the EPSC despite very weak Plan Features results. To address this, the new overriding negative factor ensures that equity plans failing to demonstrate sufficient positive features will receive an “Against” recommendation, even if their overall score otherwise passes.

|

CAP Perspective:

All public companies should consider implementing shareholder approved limits on both cash and equity for non-employee directors. According to CAP’s director compensation study of the largest 100 U.S. public companies, 77% of companies have such limits in place, covering either total pay – cash and equity (62%) or equity only (38%). Director pay limits have become a majority practice among large companies largely due to increased litigation over the past decade and the conflict of interest inherent in directors approving their own compensation. Lastly, the Plan Features pillar should be reviewed to avoid triggering ISS’s new negative overriding factor. |

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.